Are Services Taxable In Arizona . Goods refers to the sale of tangible personal property, which are generally. are services subject to sales tax in arizona? while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. are you selling taxable goods or services to arizona residents? although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. Services are generally not taxable in arizona, with the following exceptions:. does arizona charge tpt on services? are services taxable in arizona? If the answer to both questions is yes, you’re required to. Do you need to collect sales tax in arizona? You’ll need to collect sales tax in arizona if you have nexus there.

from www.templateroller.com

are services taxable in arizona? does arizona charge tpt on services? If the answer to both questions is yes, you’re required to. Services are generally not taxable in arizona, with the following exceptions:. are you selling taxable goods or services to arizona residents? are services subject to sales tax in arizona? Goods refers to the sale of tangible personal property, which are generally. while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Do you need to collect sales tax in arizona? You’ll need to collect sales tax in arizona if you have nexus there.

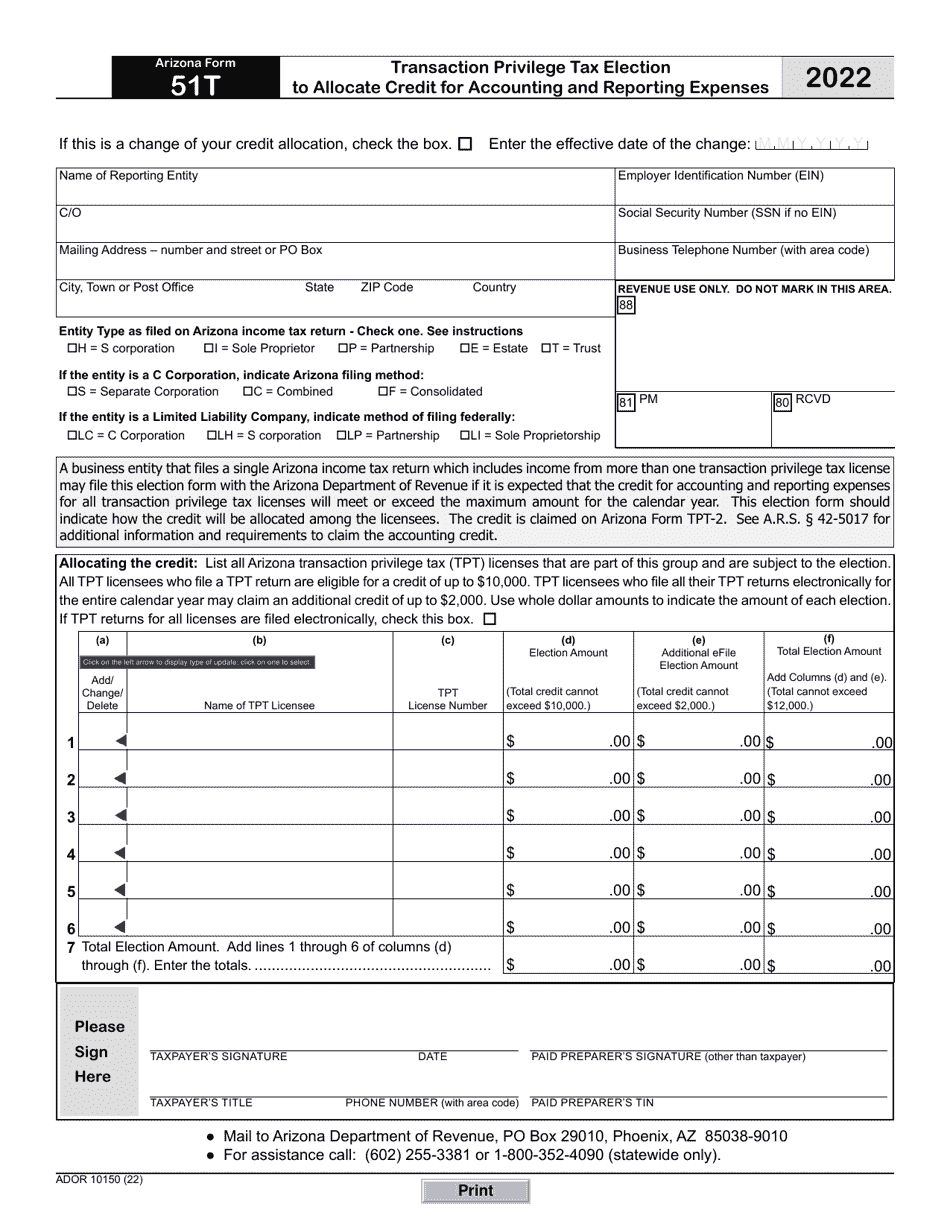

Arizona Form 51T (ADOR10150) Download Fillable PDF or Fill Online Transaction Privilege Tax

Are Services Taxable In Arizona Goods refers to the sale of tangible personal property, which are generally. while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Services are generally not taxable in arizona, with the following exceptions:. If the answer to both questions is yes, you’re required to. You’ll need to collect sales tax in arizona if you have nexus there. Goods refers to the sale of tangible personal property, which are generally. Do you need to collect sales tax in arizona? are you selling taxable goods or services to arizona residents? does arizona charge tpt on services? although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. are services taxable in arizona? Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. are services subject to sales tax in arizona?

From safasmas.weebly.com

Az tax table for 2016 safasmas Are Services Taxable In Arizona Goods refers to the sale of tangible personal property, which are generally. while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. You’ll need to collect sales tax in arizona if you have nexus there. Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax. Are Services Taxable In Arizona.

From web.facebook.com

Arizona's Best Tax Services Phoenix AZ Are Services Taxable In Arizona If the answer to both questions is yes, you’re required to. does arizona charge tpt on services? Do you need to collect sales tax in arizona? You’ll need to collect sales tax in arizona if you have nexus there. Services are generally not taxable in arizona, with the following exceptions:. are services subject to sales tax in arizona?. Are Services Taxable In Arizona.

From www.facebook.com

Monreal Tax Services Tucson AZ Are Services Taxable In Arizona Goods refers to the sale of tangible personal property, which are generally. while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. are you selling taxable goods or services to arizona residents? Services are generally not taxable in arizona, with the following exceptions:. You’ll need to collect sales tax. Are Services Taxable In Arizona.

From www.verdenews.com

Hold up on doing your taxes; Arizona tax form 1099G is flawed The Verde Independent Are Services Taxable In Arizona are services taxable in arizona? Goods refers to the sale of tangible personal property, which are generally. You’ll need to collect sales tax in arizona if you have nexus there. Do you need to collect sales tax in arizona? Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. Services are. Are Services Taxable In Arizona.

From augustawestell.pages.dev

Arizona State Tax Brackets 2024 Aline Beitris Are Services Taxable In Arizona Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. Services are generally not taxable in arizona, with the following exceptions:. Do you need to collect sales tax in arizona? although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor. Are Services Taxable In Arizona.

From www.bizjournals.com

Arizona taxable sales showing a robust end to fiscal 2016 Phoenix Business Journal Are Services Taxable In Arizona You’ll need to collect sales tax in arizona if you have nexus there. Services are generally not taxable in arizona, with the following exceptions:. Goods refers to the sale of tangible personal property, which are generally. Do you need to collect sales tax in arizona? are you selling taxable goods or services to arizona residents? are services taxable. Are Services Taxable In Arizona.

From nolanrockwell.blogspot.com

tempe az sales tax rate 2020 Nolan Rockwell Are Services Taxable In Arizona Services are generally not taxable in arizona, with the following exceptions:. are you selling taxable goods or services to arizona residents? are services subject to sales tax in arizona? Goods refers to the sale of tangible personal property, which are generally. Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other. Are Services Taxable In Arizona.

From www.taxpreparationservicephoenixaz.com

Phoenix, AZ Tax Preparation Service Phoenix, AZ Tax Preparation Service XL Tax Service Are Services Taxable In Arizona although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. If the answer to both questions is yes, you’re required to. does arizona charge tpt on services? are services taxable in arizona? are you selling taxable goods or services to arizona residents? Services. Are Services Taxable In Arizona.

From www.slideserve.com

PPT Arizona Sales Tax & Use Tax Tax Compliance Financial Services Office PowerPoint Are Services Taxable In Arizona does arizona charge tpt on services? are you selling taxable goods or services to arizona residents? while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Services are generally not taxable in arizona, with the following exceptions:. Arizona has a transaction privilege tax (tpt) that operates similarly to. Are Services Taxable In Arizona.

From atlasfirms.com

2020 Arizona Tax Credits Easy Reference Guide (AZ Residents Only) Atlas Advisors That Are Services Taxable In Arizona Services are generally not taxable in arizona, with the following exceptions:. although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. are services subject to sales tax in arizona? are you selling taxable goods or services to arizona residents? Do you need to collect. Are Services Taxable In Arizona.

From accounting.az

Tax services in Baku Are Services Taxable In Arizona Goods refers to the sale of tangible personal property, which are generally. If the answer to both questions is yes, you’re required to. are you selling taxable goods or services to arizona residents? while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. Services are generally not taxable in. Are Services Taxable In Arizona.

From www.facebook.com

Wealthnest Tax Services Chandler AZ Are Services Taxable In Arizona although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. Goods refers to the sale of tangible personal property, which are generally. If the answer to both questions is yes, you’re required to. You’ll need to collect sales tax in arizona if you have nexus there.. Are Services Taxable In Arizona.

From www.facebook.com

Batista Tax Services Tucson AZ Are Services Taxable In Arizona are you selling taxable goods or services to arizona residents? are services subject to sales tax in arizona? You’ll need to collect sales tax in arizona if you have nexus there. Do you need to collect sales tax in arizona? while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states. Are Services Taxable In Arizona.

From www.templateroller.com

Download Instructions for Arizona Form 51T, ADOR10150 Transaction Privilege Tax Election to Are Services Taxable In Arizona Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. Do you need to collect sales tax in arizona? are you selling taxable goods or services to arizona residents? You’ll need to collect sales tax in arizona if you have nexus there. although commonly referred to as a sales tax,. Are Services Taxable In Arizona.

From www.zrivo.com

How To Make Arizona Estimated Tax Payments Online? Are Services Taxable In Arizona although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. Goods refers to the sale of tangible personal property, which are generally. are services subject to sales tax in arizona? are you selling taxable goods or services to arizona residents? If the answer to. Are Services Taxable In Arizona.

From brokeasshome.com

arizona tax tables Are Services Taxable In Arizona Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. Services are generally not taxable in arizona, with the following exceptions:. does arizona charge tpt on services? are services taxable in arizona? Do you need to collect sales tax in arizona? If the answer to both questions is yes, you’re. Are Services Taxable In Arizona.

From www.formsbank.com

Arizona Form 140nr Nonresident Personal Tax Return 2016 printable pdf download Are Services Taxable In Arizona although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the. are services subject to sales tax in arizona? Arizona has a transaction privilege tax (tpt) that operates similarly to sales and use tax in other states. are services taxable in arizona? does arizona. Are Services Taxable In Arizona.

From prescottenews.com

Where do Arizona Residents Receive Most Value for Property Taxes? Prescott eNews Are Services Taxable In Arizona are you selling taxable goods or services to arizona residents? are services subject to sales tax in arizona? does arizona charge tpt on services? If the answer to both questions is yes, you’re required to. while arizona's sales tax generally applies to most transactions, certain items have special treatment in many states when it. You’ll need. Are Services Taxable In Arizona.